Delay Start-up Insurance to cover Anticipated Profit, Revenue in a Delayed Project

1. What is Delay Start-up Insurance (DSU)?

Delay in start-up (DSU) cover is designed to secure the portion of revenue which the owner:

- Requires to service debt; and

- Realize anticipated profit.

It provides protection against delays arising from physical damage caused by any type of peril included in the relevant material damage cover, i.e. the Contractors’ All Risks / Erection All Risks (CAR/EAR) cover.

Prerequisite for triggering DSU cover:

- The property insured under the material damage section sustains physical damage from an insured peril during the insurance period;

- Interference with the construction or erection works schedule caused by the loss occurrence delays the owner’s business operations.

2. Why is DSU Cover necessary?

Project owners will usually rely on the building contract for protection against late delivery. The contract will normally pass this risk to the contractor, who will be liable for liquidated or ascertained damages (LADs) incurred as a result of the delay.

However, this form of risk transfer is normally conditional; some contracts will provide the contractor with relief where the loss arises from a specified peril (for example: storm, flood). In these circumstances, the owner will not have protection against revenue losses. Even where contractual protection remains in place, contractor insolvency may make this worthless.

It is for these reasons that owners are increasingly turning to DSU cover to provide protection.

3. Key Elements of DSU Policy

3.1. Scope of Cover

- There are generally three levels of cover:

- Gross Profit: loss of anticipated revenue, including debt service costs, fixed operating costs as well as anticipated net profit, less variable costs.

- Debt service and fixed costs.

- Debt service only.

- Increased cost of working is also insured under DSU to the extent that the increased expenditure reduces the insured loss.

- Any indemnity will be limited to the Insured’s actual loss sustained within the policy parameters.

3.2. DSU Sum Insured

- The amount payable under the policy will be expressed as both a monetary and a time limit – a sum insured and a maximum indemnity period.

- It may be further defined by a maximum daily indemnity amount.

- Insurers will pay up to the amount stated as either the sum insured or the indemnity period, whichever is exhausted first.

- The maximum indemnity period purchased should ideally not be less than the maximum rebuild period envisaged.

- The sum insured should be sufficient to reflect the financial exposure for the level of coverage purchased, during the indemnity period.

3.3. Triggering a DSU Claim

- The policy will contain a DSU trigger date. It is the agreed date the project was anticipated to be complete and the commercial operations would begin. Such date may be linked to a contractually defined term.

- There are 3 key criteria for payment of a DSU claim:

- An event indemnifiable under the physical damage policy

- The resultant delay exceeds the DSU deductible

- A resultant loss of the interest insured (e.g. Gross Profit)

3.4. Aggregate Delay (Insured and Uninsured)

- The delays suffered by a project potentially from multiple physical damage events will be aggregated, leading to one overall delay period beyond the trigger date.

- Delays can also occur to a project from events that are not covered by the physical damage insurance, such as slow progress or late supply of materials. Indemnity under the DSU policy will discount time lost to such circumstances.

3.5. Key Exclusions

- Fines and penalties.

- Non damage delays (non performance, late delivery of materials etc.).

- Periods of insured delay concurrent with those from uninsured events.

- Delays due to redesigning, adding or improving the insured property.

- Inadequate funding to complete the project.

4. Calculating The Insured Delay Period

4.1. DSU Term Regarding Periods and Dates

- Scheduled Business Commencement Date (SBCD): the date on which the business could have commenced had no insured event occurred which ultimately results in a delay of the actual business commencement date.

- Actual Business Commencement Date (ABCD): the business shall be deemed to have commenced as of the issue date of the certificate of practical completion, acceptance/takeover by the owner, the date of operation start-up or the date operation could have started, whichever occurs first.

- Indemnity period: represents the maximum length of time during which insurers agree to indemnify.

4.2. Insured Delay Period

The delay period:

- is triggered on the date on which business would have commenced if no indemnifiable delay had occurred; and

- lapses with the actual business commencement date.

In other words, the insured delay is the period between the scheduled and the actual business commencement dates less any time resulting from delays caused by events for which the insurer is not liable.

4.3. Why examining “Delay” is essential?

The delays should be examined to determine its validity for a DSU claim because:

- Not all delay is covered: Only delays caused by an incident indemnifiable under the physical damage policy are covered.

- Not all delay is critical: Only delays to the project completion date are considered.

- Different delays can occur at the same time (Concurrent Delay): If there is an uninsurable delay occur concurrently with an insured delay, the period of the uninsurable delay is not indemnified.

4.4. Insured Delay Calculation

- If there are only delays due to insured incidents:

- Insured Delay = ABCD – SBCD

- If there are delays due to insured and uninsured incidents:

- Actual Business Commencement Date But-For Insured Delay (ABCDBF)

- Insured Delay = ABCD – ABCDBF

4.5. Insured Delay Period Calculation – Insured and Uninsured Incidents

Baseline Schedule:

- The project’s planned duration was 12 months.

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">As-Built Schedule:

- There was two delay incidents as follows:

- One insured delay took 3 months

- One uninsured delay took 2 months

- The project’s actual duration was 17 months, 5 months longer than the planned duration.

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">Delay Calculation Schedule:

- The Project’s Actual Finish But-For Insured Incident is calculated by subtracting the Insured Delay from the As-Built Schedule.

- The Insured Delay Period is the duration from Actual Finish But-For Insured Incident to Actual Finish.

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">4.6. Insured Delay Period Calculation – Insured and Uninsured Incidents – Concurrent Delay

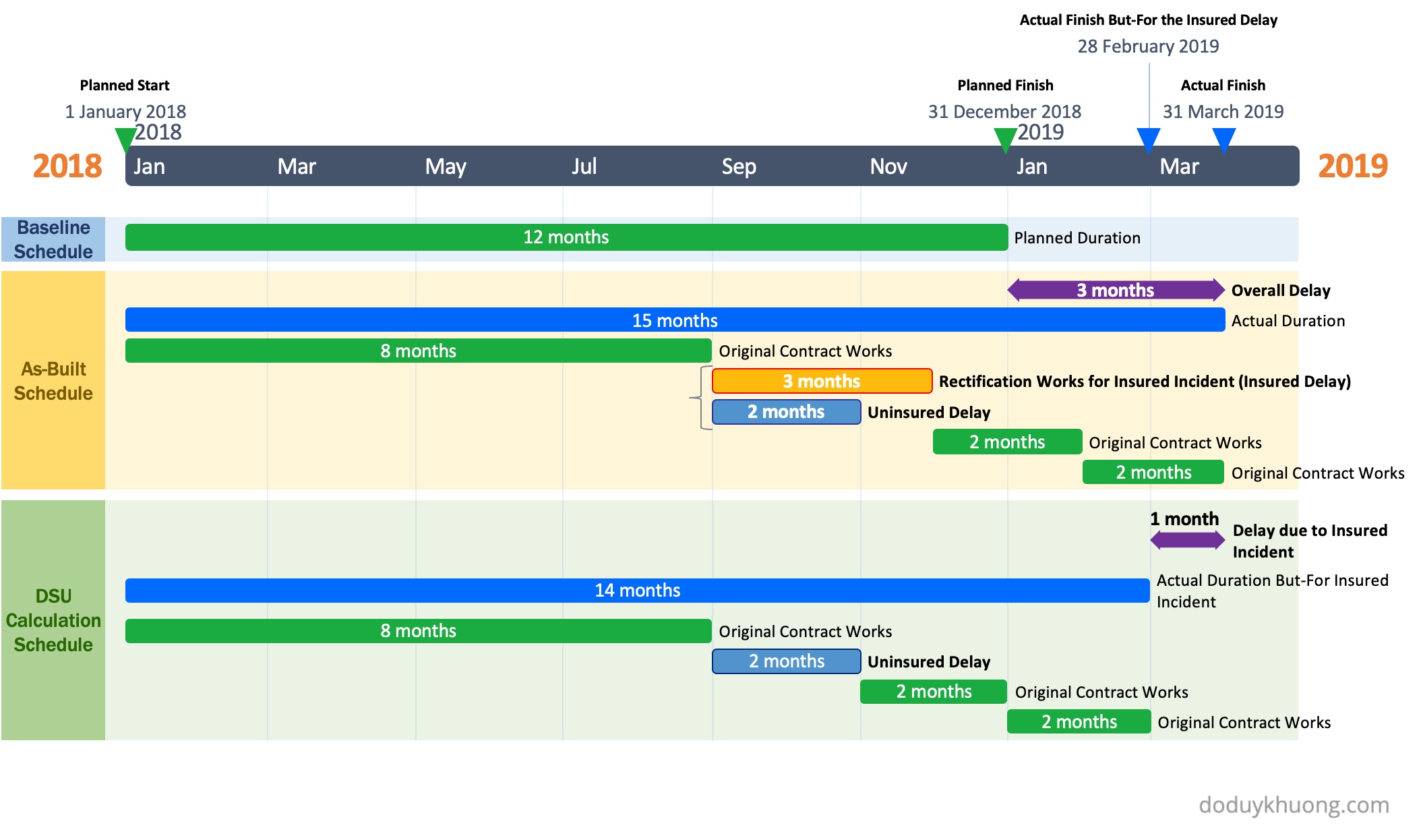

Baseline Schedule:

- The project’s planned duration was 12 months.

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2046w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2046w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">As-Built Schedule:

- There was two concurrent delay incidents as follows:

- One insured delay took 3 months

- One uninsured delay took 2 months

- The project’s actual duration was 15 months, 3 months longer than the planned duration.

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">

https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 2048w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 150w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 300w, https://doduykhuong.files.wordpress.com/2020/03/delay-start-up-insurance... 768w" style="box-sizing: border-box; font-family: inherit; line-height: 1; margin: 0px; padding: 0px; height: auto; max-width: 100%;">Delay Calculation Schedule:

- The Project’s Actual Finish But-For Insured Incident is calculated by subtracting the Insured Delay from the As-Built Schedule.

- The Insured Delay Period is the duration from Actual Finish But-For Insured Incident to Actual Finish.

Thank you for your reading.

This original article and other useful tips are also available at my personal blog: https://doduykhuong.com/2020/03/26/delay-start-up-insurance-to-cover-anticipated-profit-revenue-in-a-delayed-project/

Printer-friendly version

Printer-friendly version- Login or register to post comments

Send to friend

Send to friend